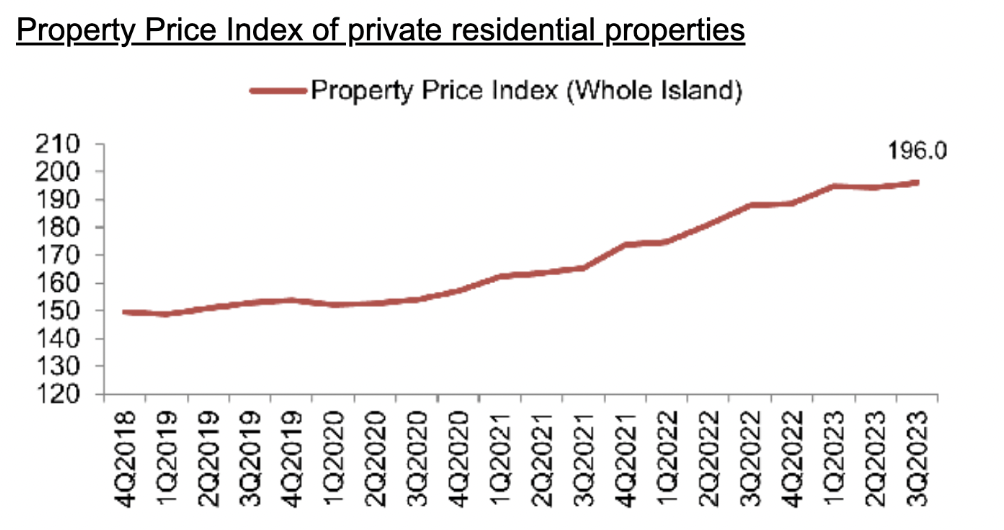

Private Residential Price Index

Prices of private residential properties increased by 0.8% in Q3 2023 following a 0.2% decline in the previous quarter.

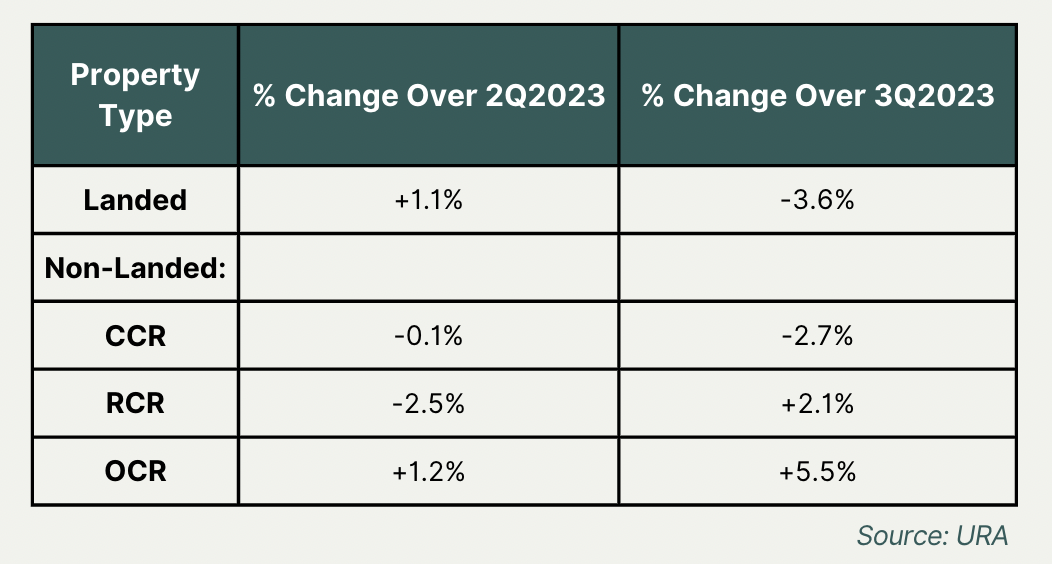

Breakdown By Market Segments

The overall price increase of 0.8% was led by a gain in prices of non-landed OCR and RCR properties.

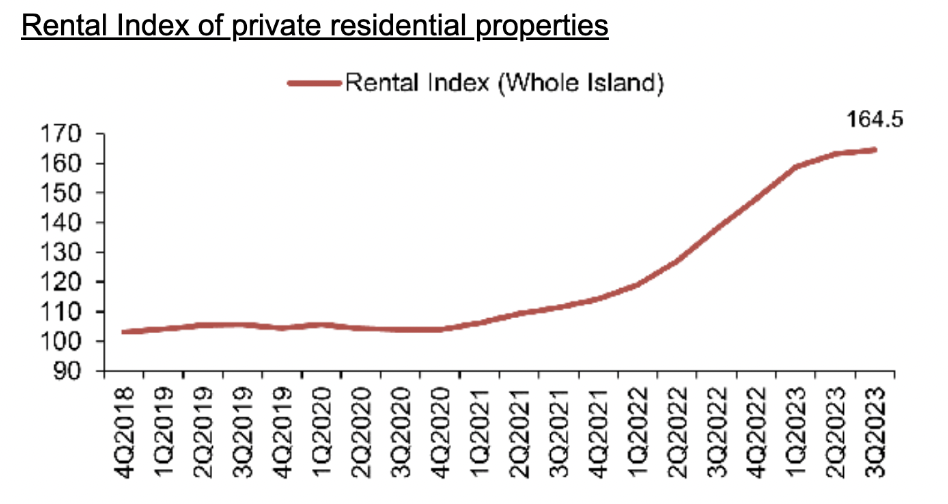

Private Residential Rental Index

Rentals of private residential properties increased by 0.8% in 3rd Quarter 2023, again lower than the 2.8% increase in the previous quarter, and 7.2% in Q1.

Rental Market Trajectory

In 2H 2023, there are 11,810 private residential units (excl. ECs) expected to be completed, which would help alleviate the tight supply situation. Therefore, we expect the rental market to ease further.

TOP projects include mega projects such as Normanton Park, The Florence Residences, Treasure at Tampines, Affinity at Serangoon, Riverfront Residences, etc.

However, it is unlikely that rents will fall back to pre-2022 levels, due to a number of reasons:

- Increased property taxes

- Higher prices (requiring higher returns)

- Higher mortgage payments from higher interest rates

- Higher rental demand from the newly imposed 15-month wait-out period for down-graders selling their condos and purchasing a resale HDB

Volume of Resale / Subsale

Overall Increase in Volume of Transactions:

- 2,900 resale/subsale transactions in 3Q2023, compared with the 2,976 units transacted in the previous quarter.

- This tells us that market demand remains strong.

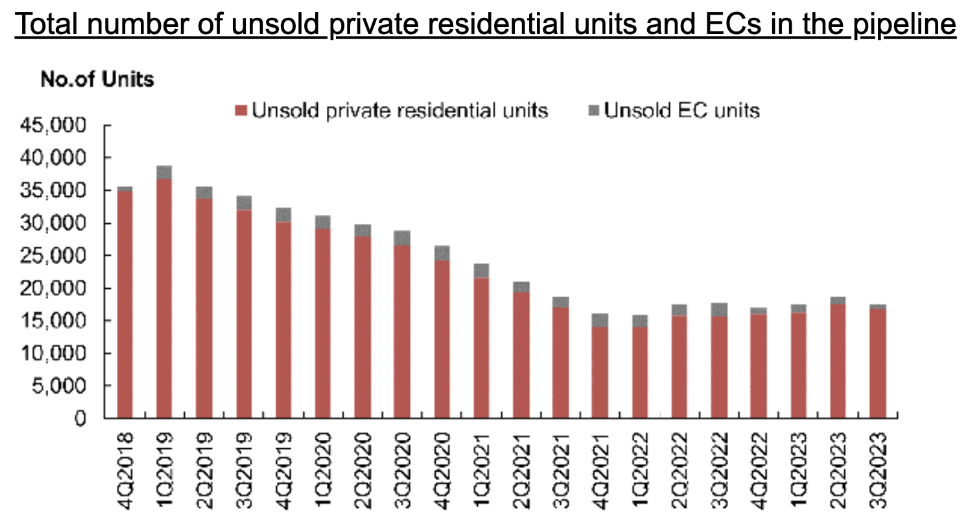

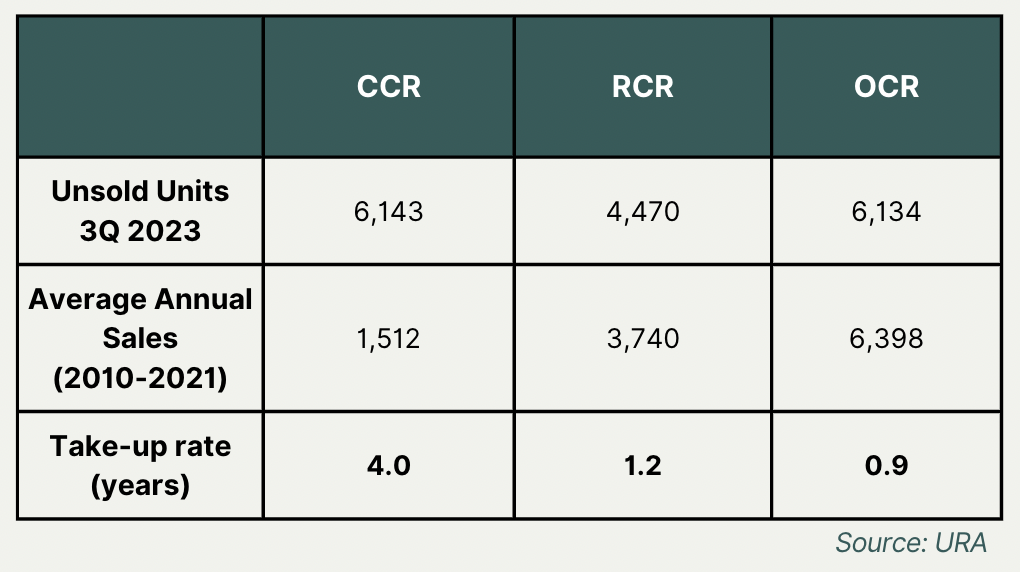

Supply in the Pipeline

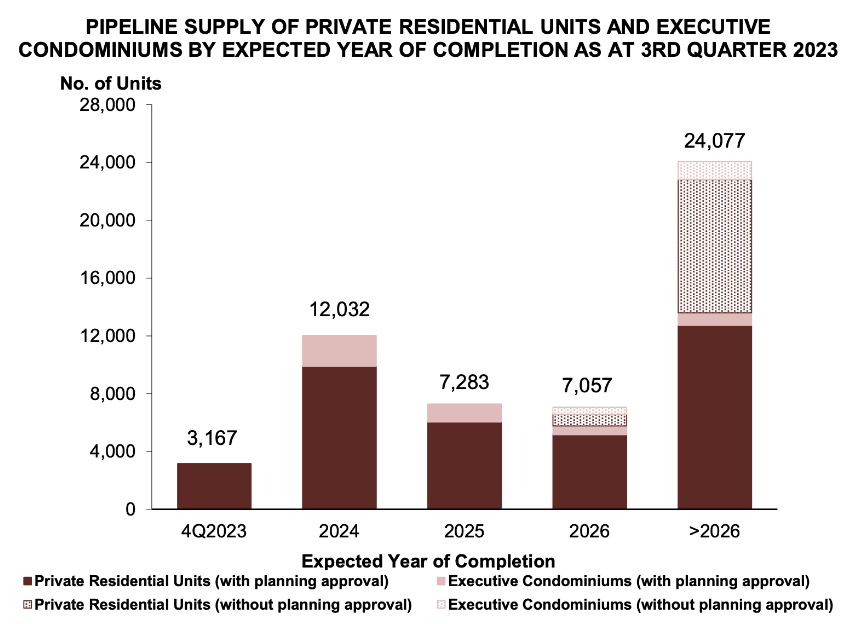

As at the end of Q3 2023, there was a total supply of 41,851 uncompleted private residential units (including ECs) in the pipeline with planning approvals, of which 17,576 units remained unsold.

Breakdown of Unsold Units

Too much supply?

Not in the RCR and OCR.

Overall unsold private housing supply (new launch) is still tight within these areas and are expected to sell out within a year’s time.

Supply in the Pipeline

- In total, around 20,400 units (including ECs) are expected to be completed in 2023.

- This would be the highest annual private housing supply completion since 2017.

In Summary,

- Properties in the CCR looks to be the most affected with the recent $2.8 billion Anti-Money Laundering (AML) case and 60% ABSD that the government has introduced.

- Price growth of 2.1% to 5.5% q-o-q for RCR and OCR properties respectively indicates that demand for properties in these regions are still strong.

- Rental market is slowing down as expected due to the large number of newly completed units coming into the market.