#1: Interest Rate Volatility

The 1-month SORA (Singapore Overnight Rate Average) has been trending down below 3% in recent weeks. But at over 7%, inflation still creates a lot of uncertainty about how the Fed will act in 2023 or how the economy will fare. The aim is to return inflation to 2%. Homebuyers will likely remain cautious.

#2: Private Residential Prices Expected to Rise

- High land and constructions costs to the developers

- Low inventory levels in current market (read our post on 14th December 2022)

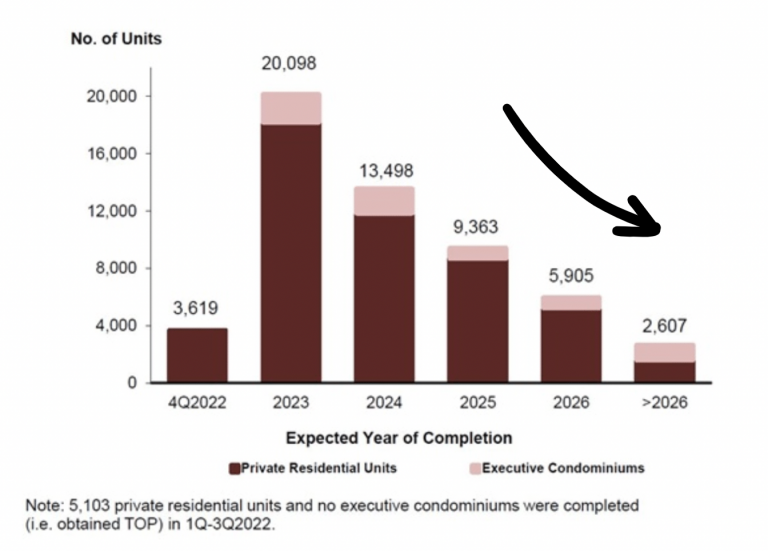

- A significant drop in private homes attaining TOP after 2023, resulting in a supply crunch of completed homes (see below)

Expected Supply Pipeline of New Completed Homes

#3: Increased Supply of New Launch Projects

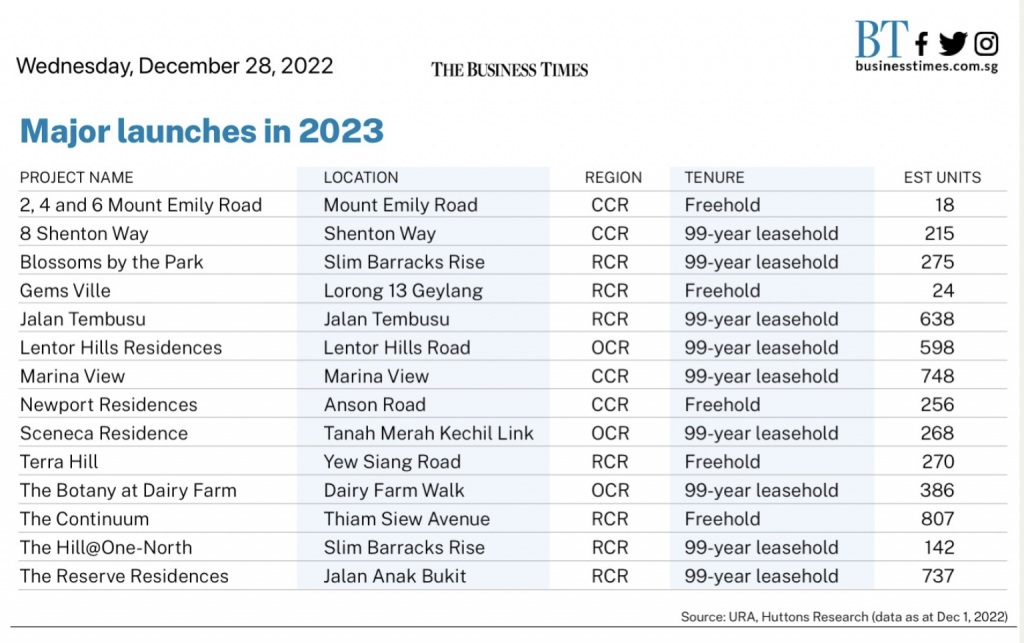

- There will be an estimated 6,000 to 8,000 units launched in 2023 as compared to 6,200 units in 2022.

- We can expect around 40 projects to be launched in 2023 as compared to <20 in 2022.

- Around 50% of new launches in 2023 are going to be located in RCR (Rest of Central Region).

Upcoming New Launches

#4: Rental Market Likely to Remain Robust

- Private rents have surged 20.8% year on year as of Q3 2022.

- Number of private homes obtaining TOP hitting 7 year high of 18,234 units may help alleviate the tight rental market

- However, rentals may still continue rising as landlords may pass on higher interest costs and property taxes.

#5: Growing Demand From Wealthy Foreigners

- This study shows that our real estate remains only slightly overvalued, despite the 20% growth since 2020.

- As a strong business hub and safe haven, Singapore real estate will continue to be wooed by wealthy foreign investors.

Reasons Why The Wealthy Favours Singapore

- China’s “Common Prosperity” policies has pushed a lot of UHNWI (Ultra-High-Net-Worth Individuals) and HNWI (High-Net-Worth Individuals) to Singapore

- Singapore has been actively attracting the ultra rich, giving tax incentives to family offices

- Singapore dollar has a history of being a stable currency for foreigners to park their assets in Singapore