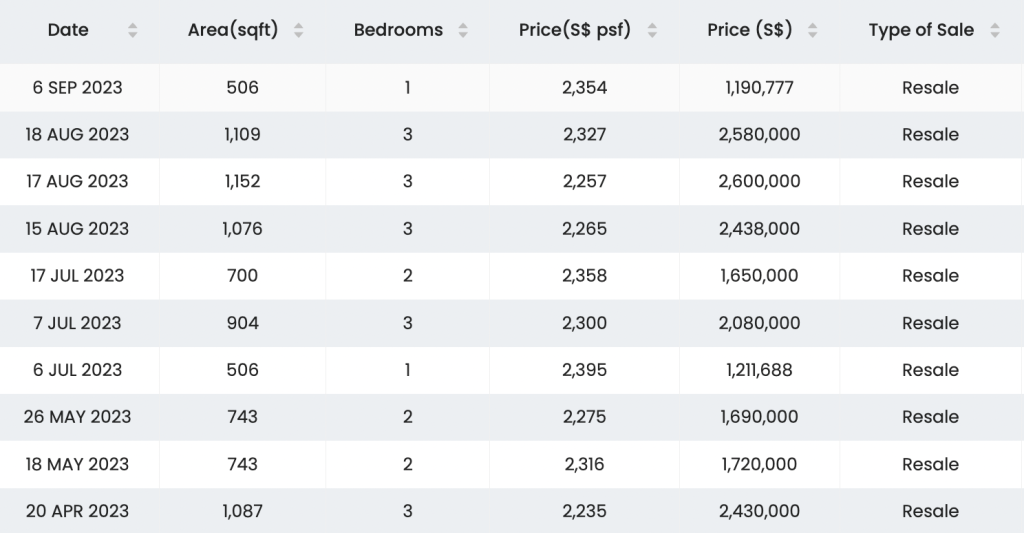

1. Past 6 Months' Transactions

- Analyse the past transactions of similar unit types with unmasked unit numbers i.e. it cannot be #13-XX.

- The exact unit numbers are important for an accurate evaluation as the facing of units within the same development can be drastically different.

- Use the condo site plan and online maps to identify the attributes of these units such as views, direction, etc, and how it compares to the one you are interested to offer for.

- Consider the frequency of transactions for similar unit types.

- For boutique developments, you may need to look further back due to the lack of recent transactions. Factor in shifts in market pricing if the transaction is over a year old.

2. Premium vs Non-Premium Pricing Differential

- A premium of $200 psf to $300 psf can exist for units with different facings, even if they are on the same floor.

- If there has been no recent transactions for a premium-facing stack in the last 12 months, the asking price may seem way higher than the last transacted price.

- To assess, delve into transactions from previous years to ascertain the historical price gaps between premium vs. non-premium facings.

- Investigate the developer’s initial pricing strategy at launch phase, which may offer valuable insights to the value placed on the premium stacks.

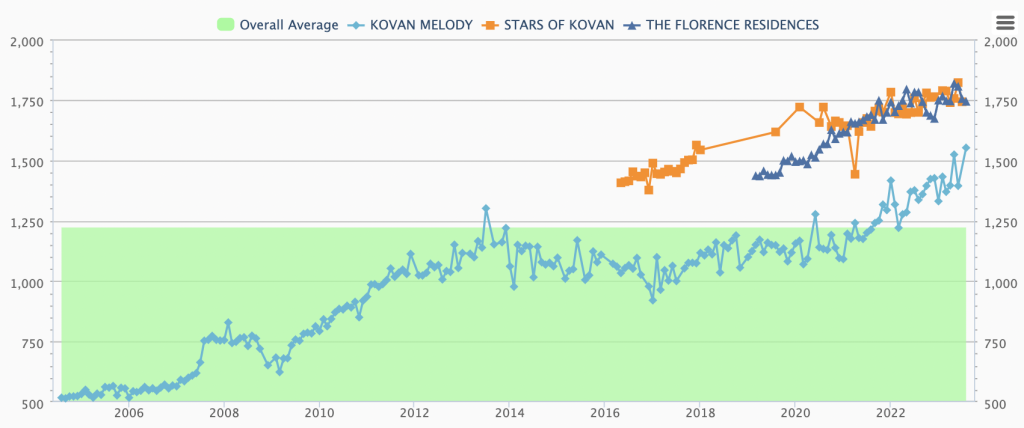

3. Options in the Same Area at the Same Price Point

- Besides looking at transactions within the condo, consider the prices of similar unit types in surrounding condos.

- The question to ask is: What else can I get at the same price?

- Conduct a holistic evaluation of factors such as floor area, layouts, views, project facilities, transaction volumes, historical price growth, potential capital appreciation etc, to ascertain if your shortlisted unit is the most favourable one in terms of your property needs, be it for own-stay or investment.

4. Bank Valuation

- If you are taking on a bank loan, it is important to check that the bank valuation can match the price in order for you to take on the full 75% loan.

- Do note that the indicative valuation that banks provide may not be accurate in certain circumstances, e.g. if this is a brand new condo that has just achieved TOP or if there have not been sufficient transactions recently.

- In these circumstances, for more accurate assessment, consult a realtor or banker.

- Usually, the banks should be able to provide a “maximum” valuation. If the seller’s desired closing price is still above this, then there is a risk that you are overpaying.

5. Price Support

- Are there any new launches in the area that have transacted at much higher prices? This would indicate the market acceptance for the area.

- How does the condo’s price trends and transaction volume look like? Has it seen a steady upward trend or has it remained stagnant for a long time? This would indicate the demand for units in this condo and the potential capital appreciation in the future.

- Is the price justified in comparison with the other resale condos in the area? Taking into account of age, project size, facilities, layouts, views etc.

In Summary,

The aforementioned points are not exhaustive but rather serve as helpful guidelines for conducting initial checks on the pricing of the unit you are interested in.

For a more comprehensive report on the investment viability of the unit, please feel free to reach out to us.