The first thing we ask clients about is their holding period

We are here to help our clients select the right property that would eventually see capital gains.

However, we do not have the power to predict the exact timing of when that can happen.

We are fortunate enough to live in Singapore, where property prices generally trend upward.

But if one buys a fundamentally sound property and sells it at the wrong time (note that the definition of “wrong” differs for every case and is an entirely different topic), there is a chance of suboptimal results.

Herein lies the importance of holding period.

A case study to illustrate this

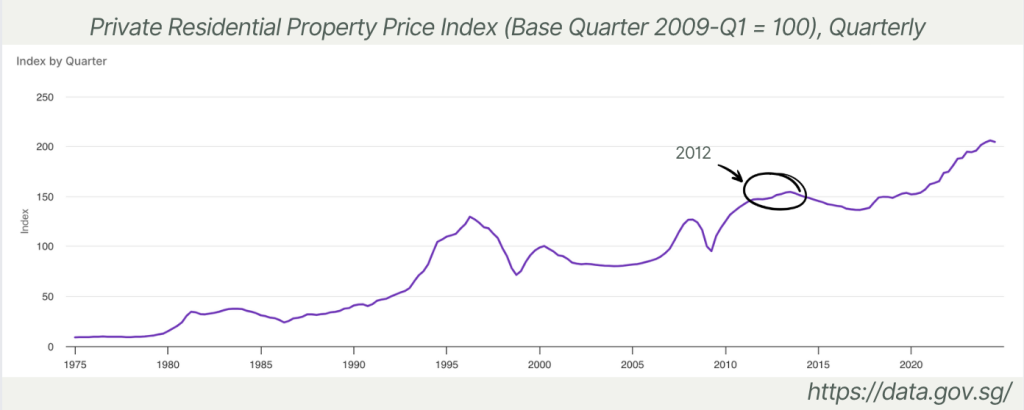

We compare the results of 3 different owners who purchased resale 2-bedders in Dakota Residences back in 2012.

2012 was one of the peak periods in the Singapore private property market in the last 10+ years.

Prices were on a downtrend subsequently due to the multiple rounds of cooling measures introduced such as Seller Stamp Duty, Additional Buyer Stamp Duty, tighter Loan to Value ratios and Total Debt Servicing Ratio.

What were the results?

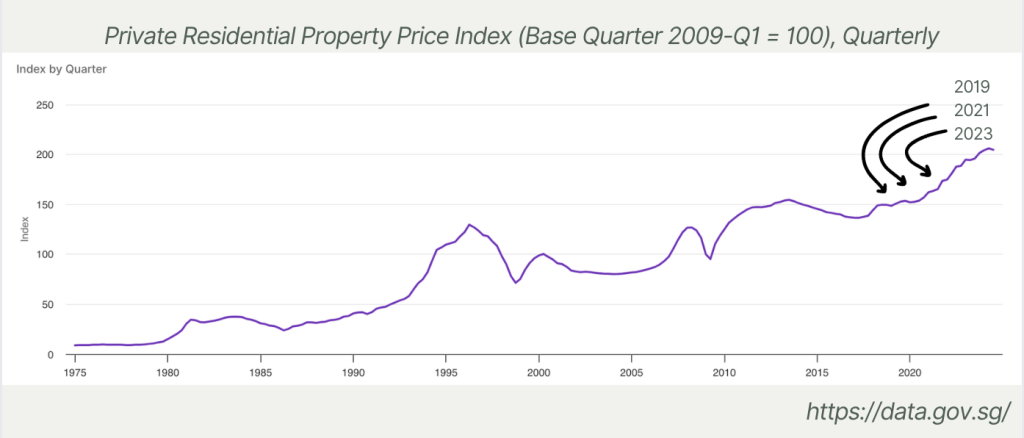

The properties were purchased between March and June 2012, and sold in three separate periods: 2019, 2021, and 2023.

In a nutshell,

Gross profits varied widely depending on the time of sale. This is why we advise all our resale buyer clients this:

“You need to have a long holding period to ride through the market, and sell only when you achieve sufficient/target profits.”

Let’s use the above example again. The first owner sold his unit at $92,000 gross profits after 7 years of holding. This is a poor result from a property which has fundamentally sound attributes (also another topic).

Unless he had compelling reasons to sell in 2019, such as family needs, he would have been better off holding onto it for a while more.

What if I want to have a shorter holding period?

By first checking a client’s investment horizon, we can then provide tailored advice based on their budget, risk profile, and desired outcomes.

If one is looking for a shorter holding period, we may not then suggest a resale property.

But our advice is always the same:

Even if one purchases a new launch property with a higher likelihood of exiting with profits in a shorter time, one still should not purchase a property with the expectation of having to sell it within a few years.

Simply because no one can predict the market.

Bonus food for thought point

Using the first owner as an example again.

If this purchase was for his own stay, he did enjoy the benefits of living in a relatively new condo (2 years old at time of purchase) in a great location.

And if this purchase was an investment, there would have been rental income collected over 7 years, during which the tenants have been paying down his loan and part of his loan interest as well. This would have contributed to the total profits.

So if he had to sell this property in 2019 for important reasons, we don’t think it is for us to judge whether it was a foolish move or not.