End of Interest Rate Hikes

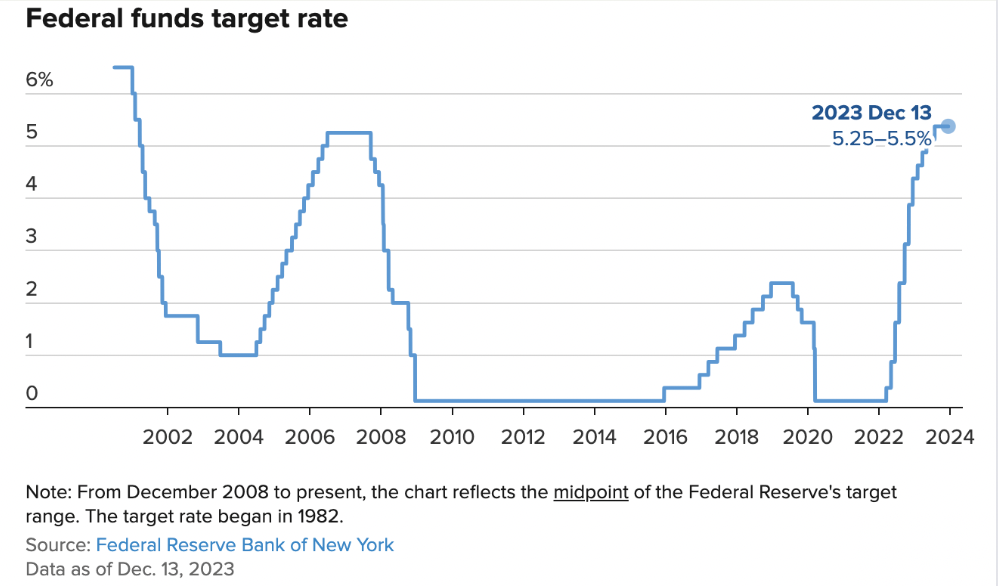

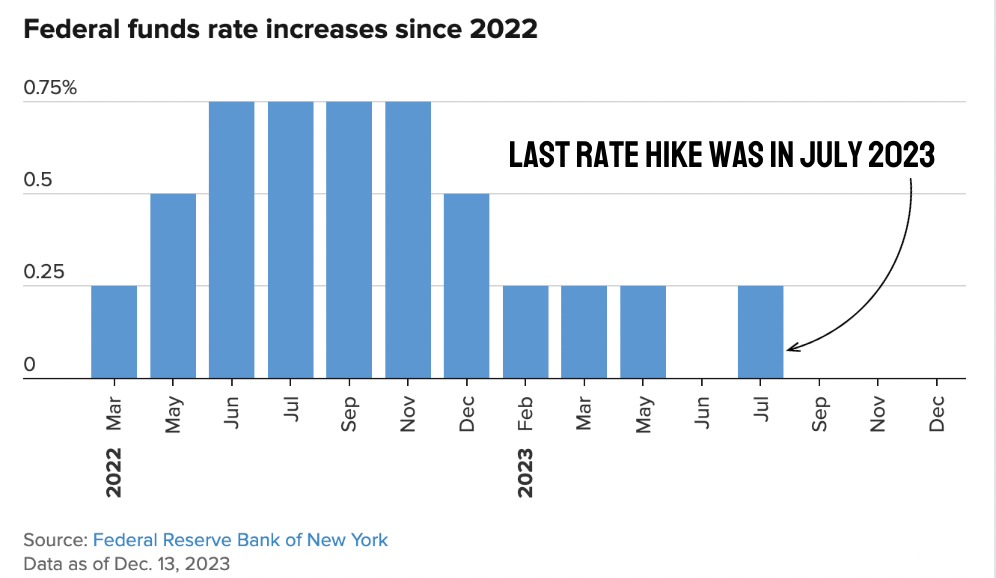

On 13th December, the Federal Reserve maintained its key interest rate for the 3rd consecutive time, signalling potential rate cuts (up to 6 times) in 2024 and beyond.

Rate Cuts As Early As March 2024?

There are talks of potential rate cuts as early as March 2024. Historical trends show that the Fed usually pauses 6-12 months before cutting, aligning with analysts’ consensus.

Impact on Property Market

DEMAND

1. Increased Affordability

When interest rates fall, homebuyers are able to take on higher loan amounts from banks, boosting affordability and driving up demand for properties.

2. Increased Investor Activity

Low interest rates may encourage property investment as investors pursue superior returns compared to other low-yield alternatives.

SUPPLY

1. Potentially Lesser Resale Supply

Existing homeowners are likely to refinance their mortgages with lower interest rates. This reduces monthly payments, which increases holding power as they choose to retain properties rather than selling, subsequently diminishing the housing supply.

With falling interest rates, we expect an upward pressure on property prices.

However, it is important to note that while lower interest rates generally have positive effects on the property market, other economic factors can also influence our local market dynamics.