Ask Yourself: Why Not Now?

If upgrading has always been part of your plans (only a sooner or later thing), and you can already afford to do so now, you need to identify the reasons for not taking action.

Are there legitimate reasons that make upgrading unsuitable now, or are you just fearful of change, or even procrastinating due to the potential hassle?

The Problem of Getting Priced Out is Real.

Let’s look at the potential impact on your plans if you delay your upgrade.

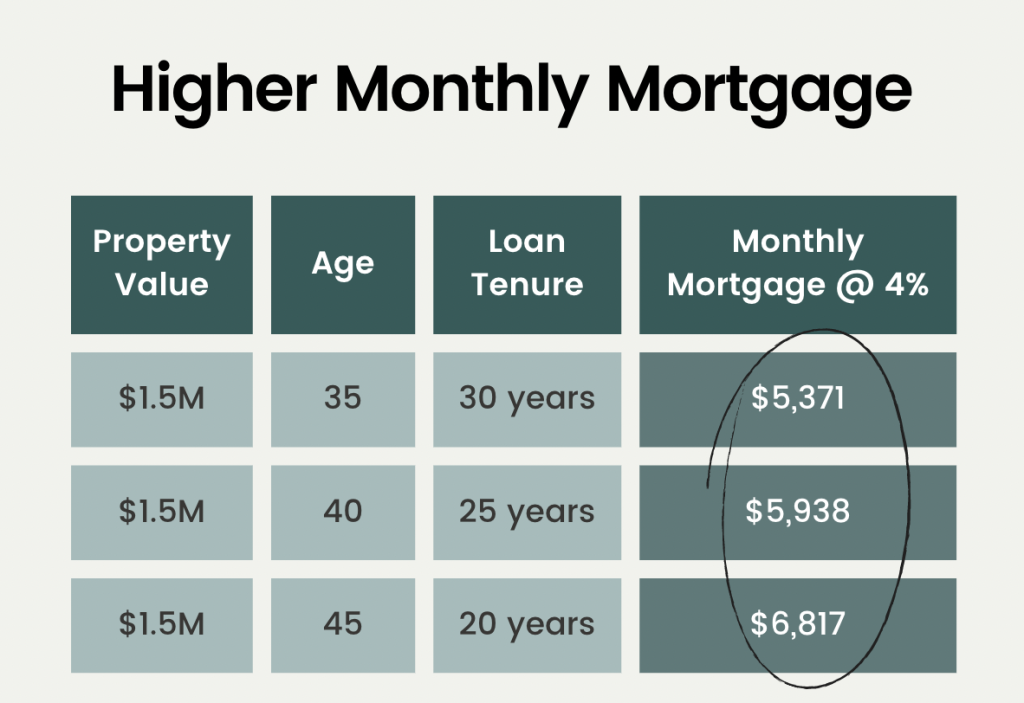

The above table illustrates how much your monthly mortgage increases if you delay your upgrading plans while wanting to be able to afford a property of the same quantum (e.g. $1.5million).

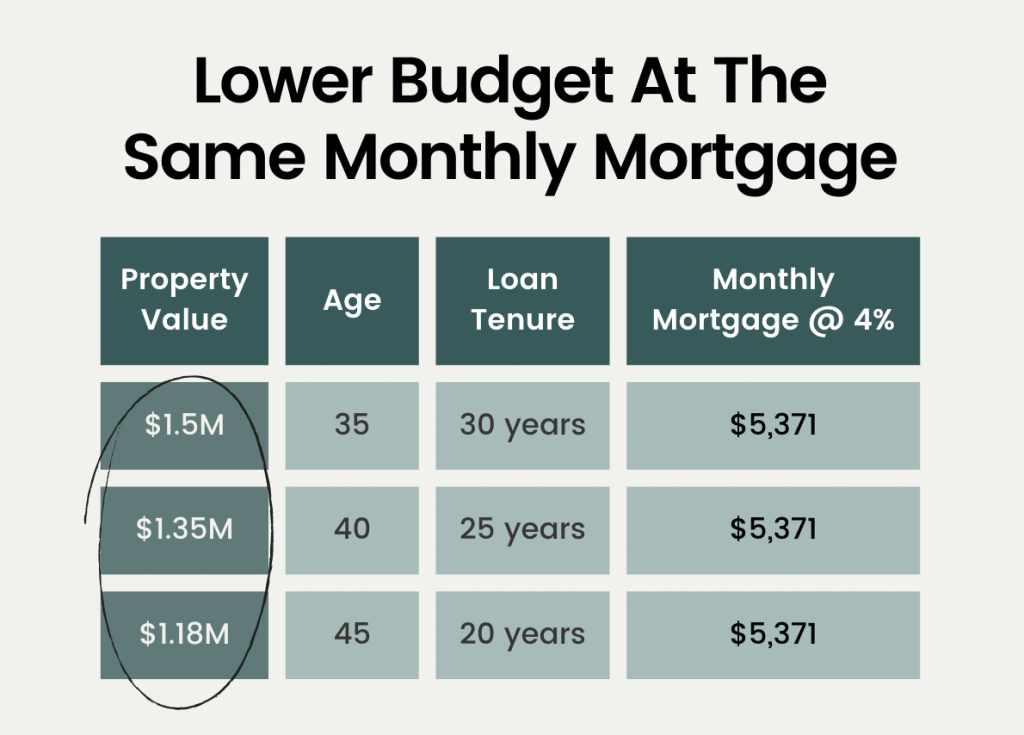

The above table illustrates how much your budget falls if you delay your upgrading plans while wanting to be able to maintain the same monthly mortgage payment.

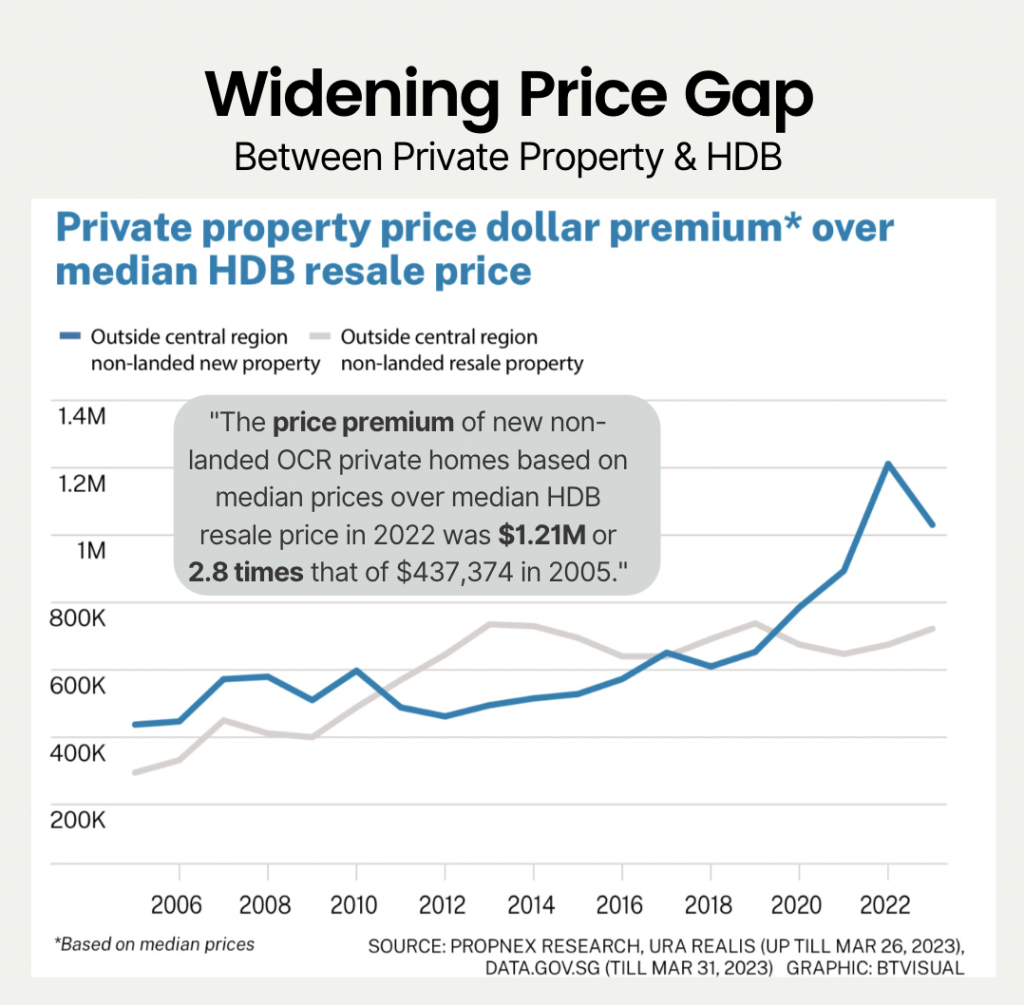

In the last 2 decades, the price gap between HDB and private property has been widening.

Increasing private property prices can be attributed to the following factors:

- Land Prices

- Construction Costs

- Professional/Legal/Tax Costs

How likely would these costs drop in the future?

With the government committed to managing the current supply-demand distortion, there is a high likelihood of HDB prices stabilising or even dropping from current peaks.

Even if HDB prices go up by another 10% over the next few years, it is not enough to help one afford a similar increase in the private property market, simply because the quantum is much larger.

In a nutshell, what we gather is that, even though it is not impossible to, it typically gets harder to upgrade from the HDB you are staying in as you age, if you are solely relying on only earning power and savings.

Speak to us if you’d like a non-obligatory free consult!