Project Overview

Developer: CapitaLand

No. of Units: 368

Estimated Vacant Possession Date: 30th November 2028

Site Area: 83,647sqft

Project Makeup: 2-storey commercial podium and 38-storey residential tower

Directly Linked To: Jurong East MRT, Integrated Transport Hub, IMM, Westgate, JEM

Entry Price of J'Den - Comparable New Launches

The LakeGarden Residences

- Closest new launch to J’Den geographically

- 6 bus stops to Lakeside MRT

- Prices have averaged $2083psf – $2239psf across 1-5 bedroom types

Based on the difference in locality and convenience, we should be able to accept a 10%-15% higher price for J’Den.

The Reserve Residences (TRR)

- Similar to J’Den in terms of direct access to an Integrated Transport Hub, shopping mall, etc.

- Prices have averaged $2411psf – $2705psf across 1-5 bedroom types

As The Reserve Residences is a project on a larger scale— sitting on a larger land plot with better facilities and a bigger mall— we would consider J’Den to be at a reasonable price if it falls below TRR’s transacted price range.

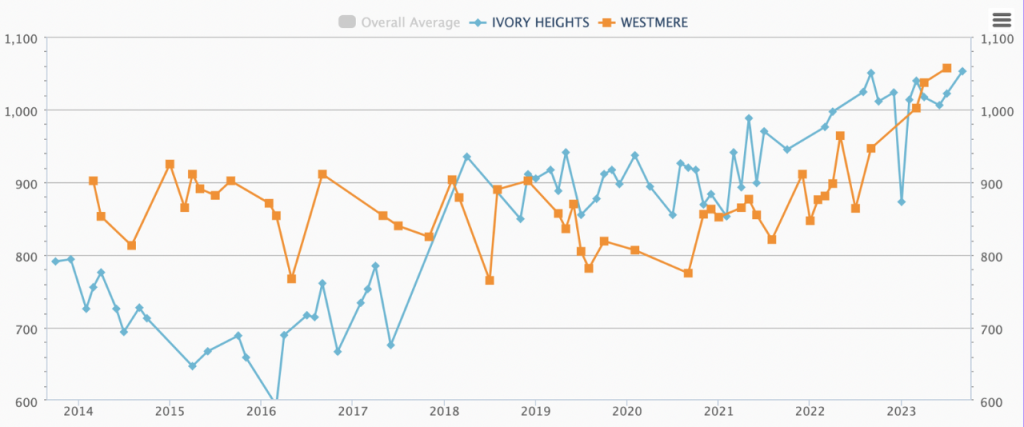

Entry Price of J'Den - Nearby Resale Prices

- J Gateway is the only project that is comparable (TOP in 2017; 6 years old currently)

- Recent transactions at J Gateway have been averaging $1800-$2100psf

- The other 2 projects near Jurong East MRT station are too old (24 to 30 years old 99 year-leasehold projects) to be relevant as they serve an entirely different target market

Considering the age difference of 11 years, the current price gap would be $300psf gap to the released starting from prices of J’Den at $21xxpsf.

Despite their age, these leasehold condos, which are 24 and 30 years old since their TOP, continue to show upward price trends and strong transaction activity.

This gives us a good indication of demand in the area.

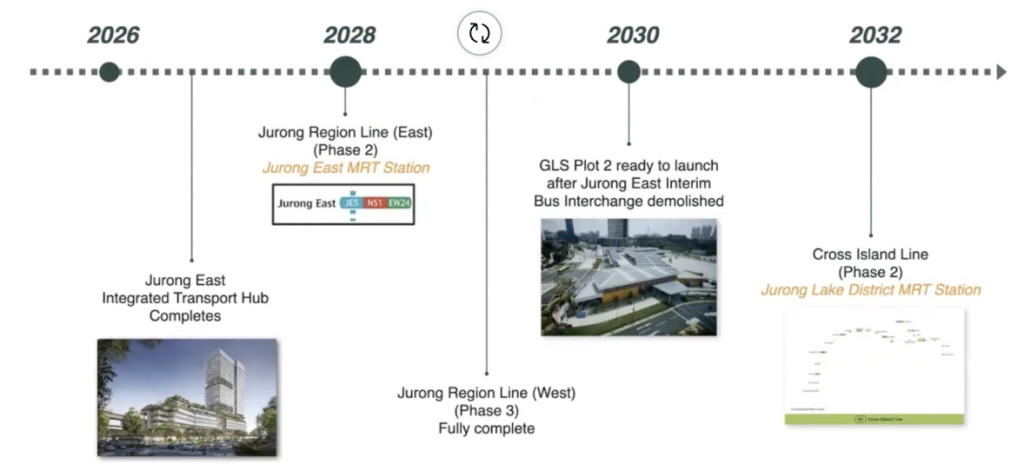

Exit Strategy - Jurong Lake District Transformation

- Envisioned to be Singapore’s largest mixed-use business district outside the city centre

- The focus of new development in the next two decades by the government

- By 2027, the Integrated Transport Hub and Bus Interchange will be completed to further enhance bus connectivity

- By 2029 and 2032, the Jurong Region Line and the Cross Island Line will be completed respectively

Low Supply + High Demand = Capital Appreciation

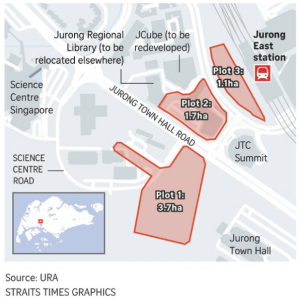

Exit Strategy - Low Supply

At Jurong East Interchange, there is only 1 competing condo i.e. J Gateway.

Even though there are 3 other white sites (6.5ha), the government has planned for only 1,700 new homes in this area.

Multiple Points For A Safe Exit Strategy

After the 3-year Seller Stamp Duty period ends, the Integrated Transport Hub, various MRT lines and white sites would be completed to provide a safe exit strategy.