“Does the rental cover my mortgage payment?”

This is typically the first question most people ask when considering renting out an investment property. Understandably, this is crucial for most investors from a cash flow perspective.

However, this post highlights another important aspect beyond net cash flow: how your tenant contributes to paying down your mortgage i.e. helps to pay for your house.

Using an actual example

- Property Price: $1,485,000

- Interest Rate: 2.85% p.a. (30 years)

- Monthly Mortgage: $4,606

- Monthly Rent: $5,300

- Monthly Maintenance Fees: $360

- Monthly Property Tax: $288

Net Cash Flow:

Monthly Rent – Monthly Mortgage – Monthly Maintenance Fees – Monthly Property Tax = $46

While this calculation reveals the investor’s monthly net cash flow, it doesn’t illustrate the extent to which the tenant is contributing to paying for the house.

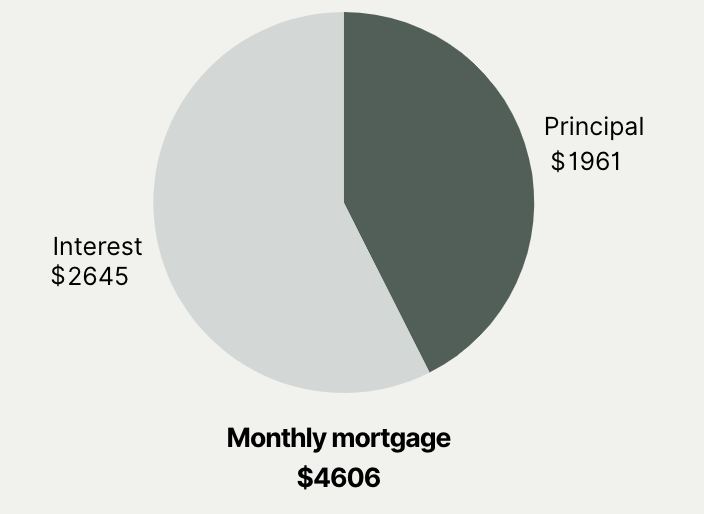

Mortgage is made up of principal and interest

Remember: Not the entire mortgage payment is an expense; only the interest portion constitutes as an expense.

This is the estimated breakdown of the mortgage payment. Note that the interest expense decreases each month as the loan principal is gradually repaid.

Cash Flow vs. Equity Growth

When you make a mortgage payment, the portion going towards the principal is lowering your outstanding loan amount i.e. building equity.

In this case, to find out how much the tenant is helping to pay for the house per month, the calculations should be:

Monthly Rent – Monthly Mortgage Interest Expense – Monthly Maintenance Fees – Monthly Property Tax = $2,007

So essentially, this tenant is paying the principal amount in full for this investor. If this investor continues to rent this property out for 30 years, his house will eventually be fully paid for by the tenant.

At the end of the day

In Singapore, not all rental properties generate positive cash flow. Understanding the concept explained above can help you recognise that a negative cash flow does not necessarily imply that your investment is not progressing towards your financial goals:

- Higher potential returns: When you eventually sell, your profits are not just from capital appreciation; it will be also boosted by the significant equity built through the tenant paying down your debt for you over the years.

- True passive income: Once the mortgage is fully paid off, the rental income becomes entirely yours, providing a consistent and reliable stream of passive income.