90 units were on discount, out of which 87 were sold.

One Bernam, a 99-year leasehold mixed-use development with 351 units in Tanjong Pagar, has been on the market since 2021.

Last weekend, the developer offered discounts of 15% to 27% on the remaining units.

It is speculated that the developer is motivated to urgently clear unsold stock as the development’s ABSD deadline approaches.

Developers have 5 years from land acquisition date to sell at least 90% of their units or face an ABSD payment of 40%.

The developer bought the land in September 2019.

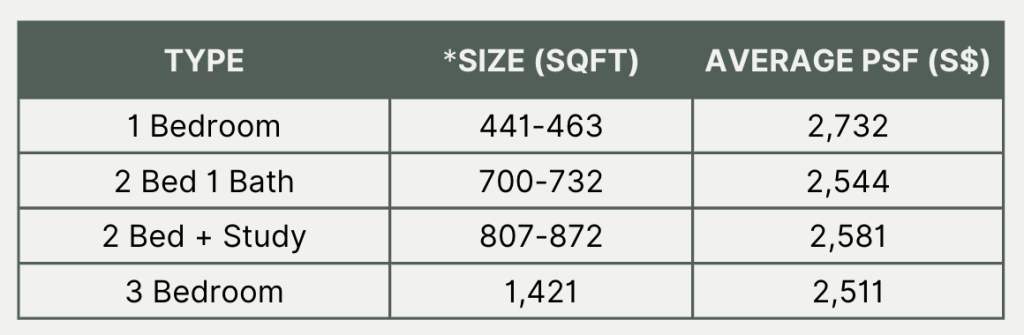

One Bernam’s average prices before discount

23% of units (80 units) sold on launch day back in May 2021, at an average price of $2,650psf.

The above table shows the average transacted prices from May 2021 to Dec 2024.

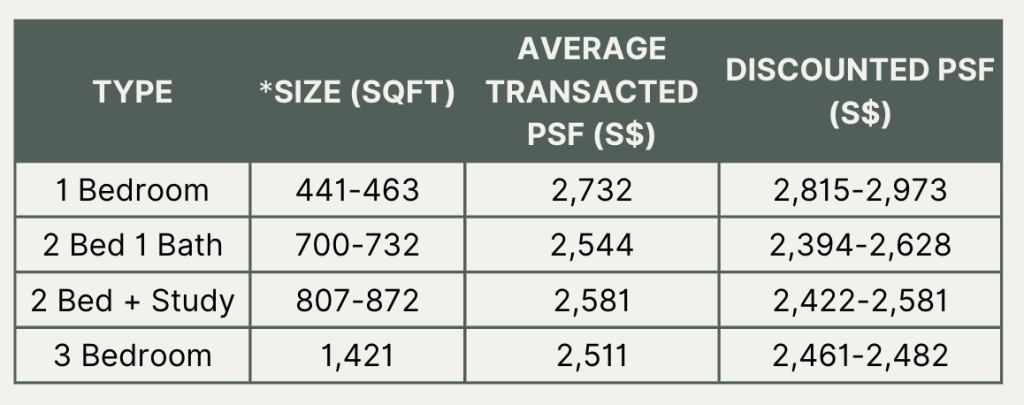

What were the discounted prices over the weekend?

With the discounts, some units were priced at 2021 levels or even lower.

This raises the question: Why did the developers go to such lengths to clear their remaining unsold stock?

Why does One Bernam need to give discounts when recent launches have seen such strong take-up rates?

The developer has been selling since May 2021, with 25% of units remaining unsold as of January 2025.

Looking back, it appears that there was insufficient demand for this development in the first place.

The developer had to significantly discount prices for this Tanjong Pagar development, bringing them down to current OCR/RCR new launch price levels.

This suggests that initial pricing may have been unrealistic or not in line with market demand.

Some fundamental attributes that may have contributed to a high percentage of unsold stock after nearly 4 years

Target Market:

With 91% of units being 1 or 2-bedrooms, One Bernam appears to be primarily targeted at investors, unlike many other new launches in the OCR/RCR with a more balanced mix of unit sizes targeting own-stayers.

Location:

Located in Tanjong Pagar, One Bernam may not be the most desirable location for many Singaporeans seeking an own-stay property, reflected in low transaction volumes and high number of unprofitable transactions in neighbouring developments.

Layout:

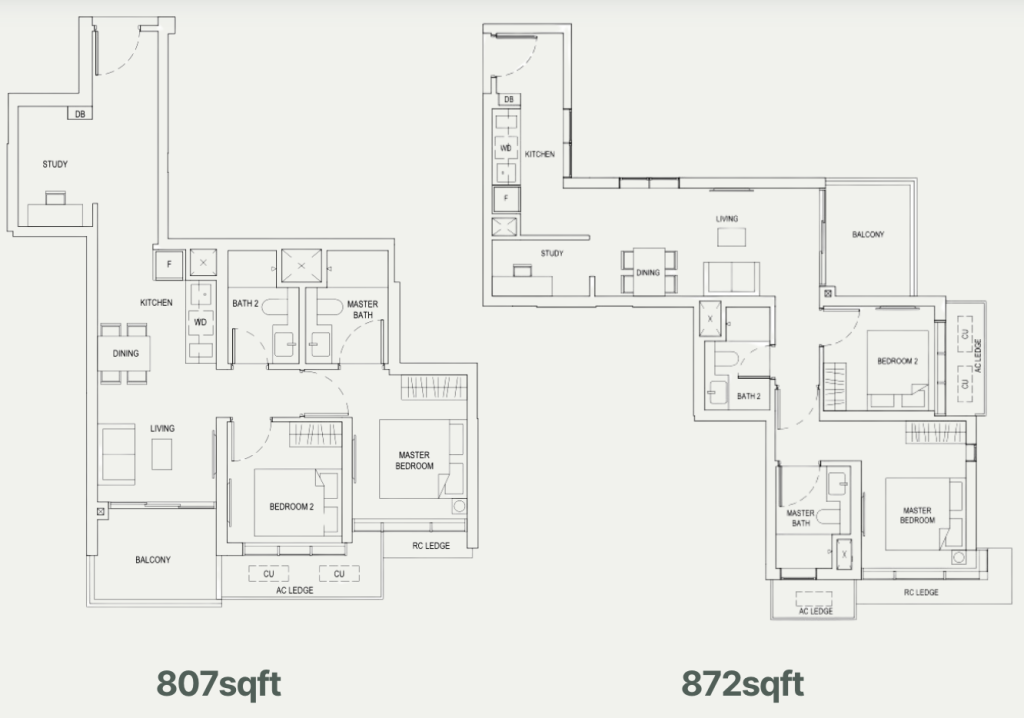

See examples of 2 bedroom + study layouts below.

The layouts exhibit several obvious flaws, including long corridors, limited kitchen space, and small bedrooms. Overall, the units appear inefficiently designed for their size.

Back to our first question: Is this a good deal?

For buyers who secured a discount, the deal is considerably attractive as they acquired the unit at a lower price, compared to many previous buyers.

However, in terms of fundamental attributes, this development does not check many boxes in the HausLife Investment Framework.

Coupled with the high percentage of unprofitable transactions in Tanjong Pagar developments, we have concerns about the long-term exit strategy for these units.