Our client’s brief.

Budget – $850k

Holding Period – 5 years

Objectives – Pure Investment, ideally a property that is both cashflow positive and has good appreciation potential

After going through the HausLife Investment Framework, this is the unit purchased.

Property Price – $812,000

Size – 474 sqft (1 bedroom unit)

Rental – $3,600 (newly signed 2 year tenancy)

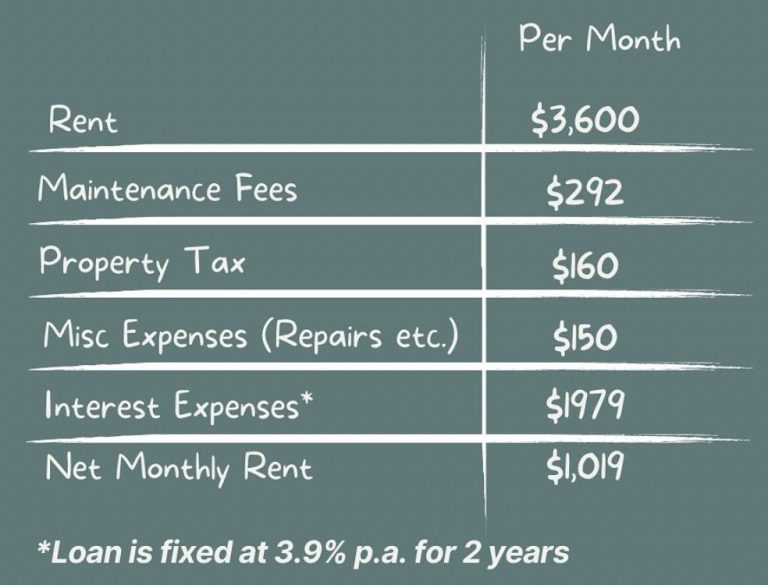

Loan – 3.9% fixed for 2 years

Return on Investment

Capital Invested

= 25% Downpayment + Buyer’s Stamp Duty

= $221,960

Return on Capital Invested

= Net Monthly Rent/Capital Invested

= $1,019*12/$221,960

= 5.51%

Projected gains after 5 years.

We make the following assumptions:

– Property value only appreciates by 5%

– Interest rate remains at 3.9% p.a.

– Monthly rental remains at $3600.

Total Gains (Rental Gains + Capital Gains)

= $1,019 * 60 months + 5% * $812,000 = $101,740

Total Return on Investment (Total Gains/Capital Invested)

= $101,740/$221,960

= 46%

Other Factors

The HausLife Investment Checklist also looks at other factors that affect the eventual exit strategy.

Here are some examples:

– Good transaction volume indicating demand for 1 bedders in the area

– Rental volume and trends

– Discovering the lack of supply of 1 bedroom units with good facing in the area

– Upcoming new development that is priced 20% above this unit

In a nutshell…

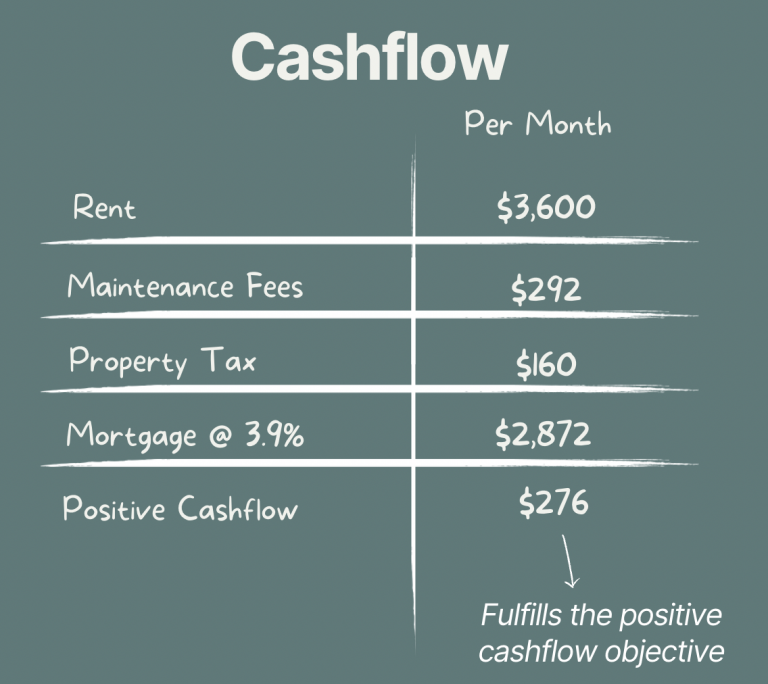

Many people are fearful with rising interest rates and may think that it is not a good time for property investment.

However, these are all sweeping statements.

Every case differs.

As you can see, there are still opportunities in the current market where the numbers show us that we can still counter the high interest rates and emerge from this investment with a good ROI.

Speak to us if you’d like a non-obligatory free consult!