A Really Long “Lock-In” Period

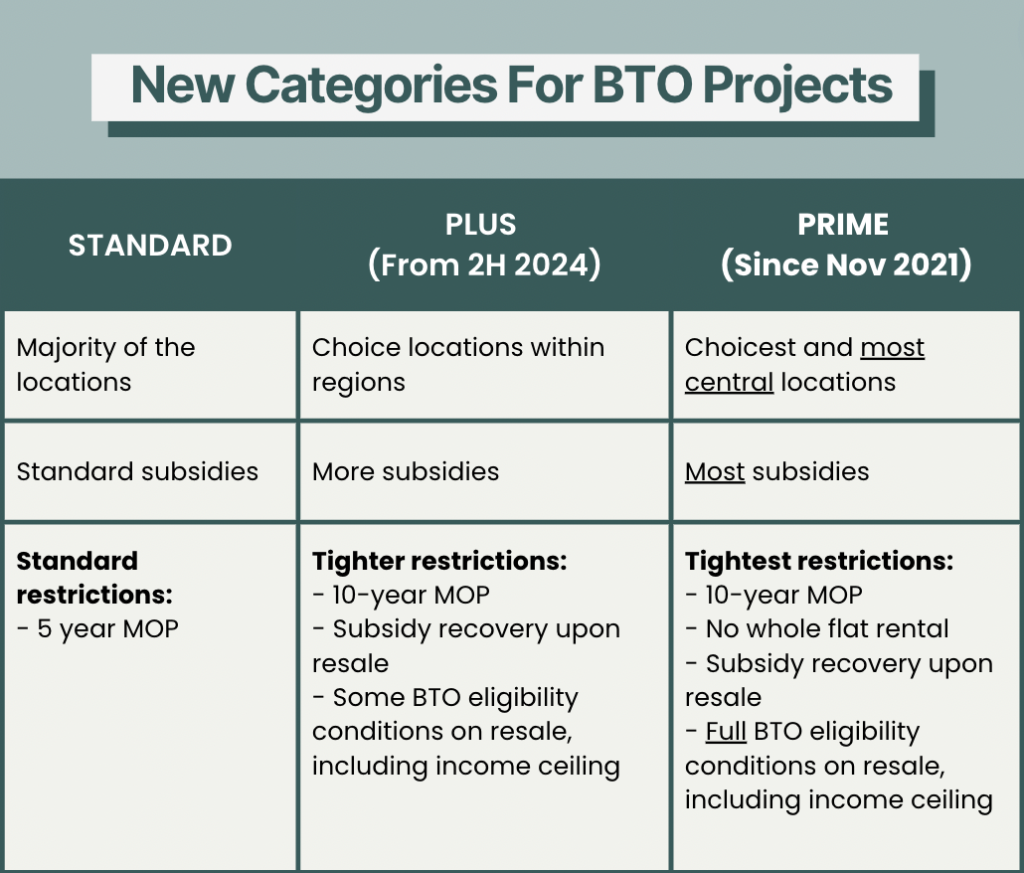

Anyone applying for a Plus or Prime flat would be subject to a 10-year Minimum Occupation Period (MOP), which essentially means you are tied to your HDB flat for almost 15 years (10 years in addition to the construction time which is typically 4-5 years).

This can impact buyers in 2 ways:

- Delayed Asset Progression Plans

- Less Flexibility

1. Delayed Asset Progression

For example, if you successfully secure a BTO flat at age of 25, you and your spouse can only make your next move in the property market when you are 40 years old.

At that point, your loan tenure would have become shorter, hence reducing your loan quantum and affordability for your next move.

With the government’s clear objectives and policy implementation to prevent HDB prices from growing too quickly, it is likely that there would be a continued widening price gap between private property and HDBs.

This will make it harder for you to upgrade from both the reduced loan quantum and profits from the sale of HDB.

2. Less Flexibility

You’ll need to REALLY plan ahead and know what you want, for you and your family in the next 15 years, now.

Everything from distance to your child’s school, parents’ home, potential work place, to making sure this space and environment is not something you will grow out of fast.

In our experience with many clients, plans can really change within a short period of time. So we would definitely encourage you to think this through very very carefully.

“Ceiling” For Resale Prices of Prime Flats

Full BTO eligibility is needed for buyers of resale Prime flats.

This means a couple cannot earn more than $14,000 in order to purchase a resale Prime flat.

Their maximum HDB loan quantum in this case would be around $885,000, which puts their maximum budget at around $1.1mil, unless they have spare cash to top up their budget.

This is a clear move by the government to artificially stop HDB prices from exceeding this price range in “prime” areas.

Key Takeaways

1. HDB flats are not meant to be seen as an investment; our government would not allow it, as they need to keep it affordable for the masses.

2. Only lock yourself in for the next 15 years only if you really know what you want.

3. If property investment has always been part of your financial goals, and you can afford it, look for something in the private property market.

Time and age are things that one can never gain back.

Speak to us if you’d like a non-obligatory free consult on understanding the new BTO categories and how they affect you!