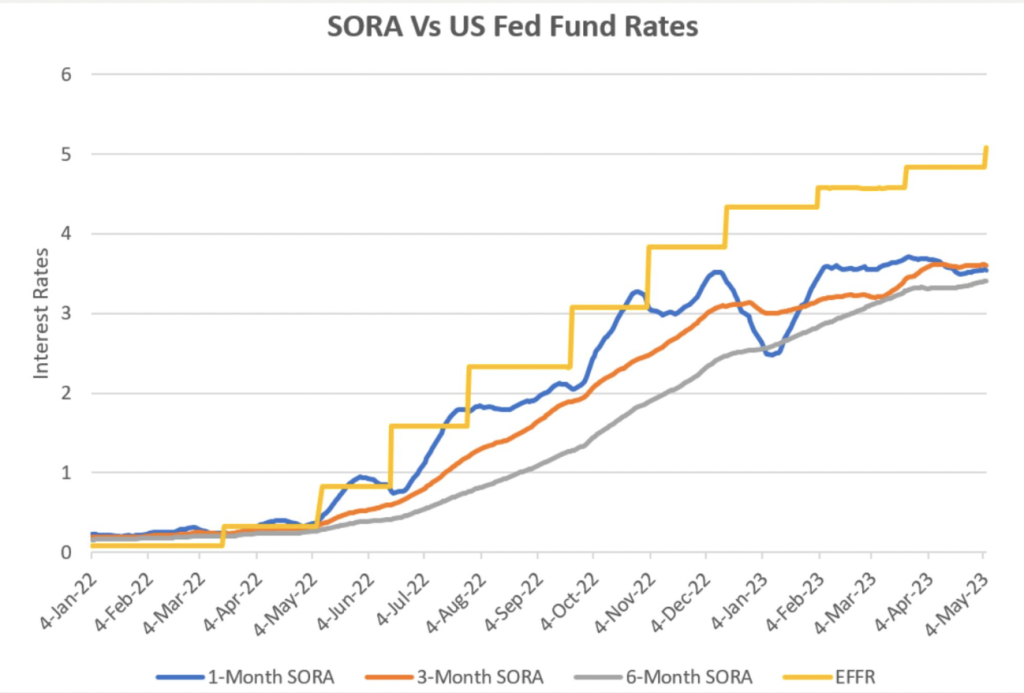

Highest Interest Rates Since 2007

In May, the Federal Reserve approved the 10th interest rate hike in the last 14 months to a new target range of 5% to 5.25% but dropped a hint that the current tightening cycle is at an end.

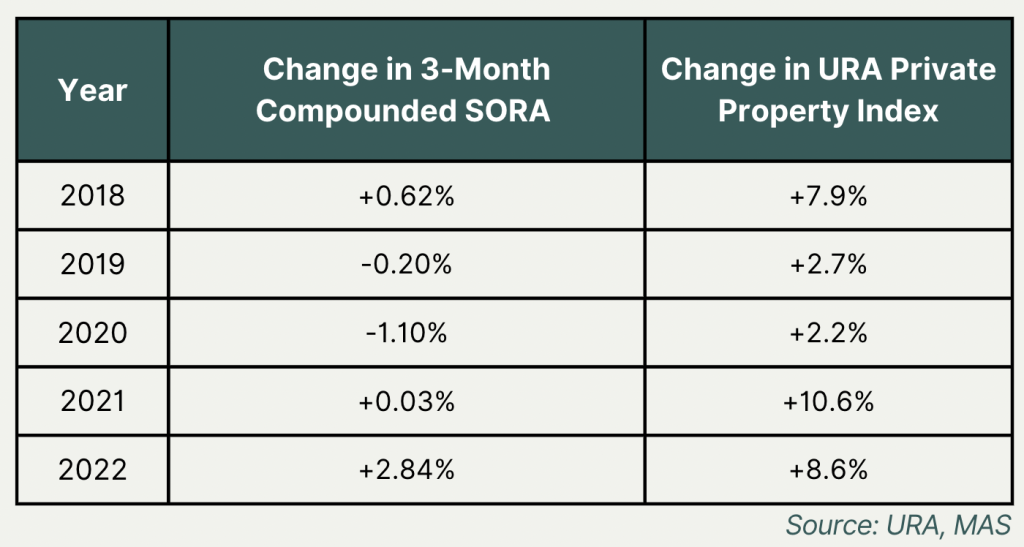

Is There A Direct Relationship Between Property Prices & Interest Rates?

- 2018-2019: Interest rates rose, property prices rose.

- 2019 to 2020: Interest rates fell, but property prices continued rising albeit at a slower pace.

- 2021 to 2022: Interest rates rose at a much faster pace, and property prices rose at its fastest pace too.

Property Prices Vs. Interest Rates

Theoretically, these 2 factors should be correlated as interest rates affect affordability directly.

But as we can see, historically, this is not necessarily the case for our local property market.

So, should the movement of interest rates determine your decision to purchase a property?

Many clients have asked us whether they should wait for interest rates to fall before entering the market. But the question is, why?

It is never wise to time the market.

As we can see from the data, interest rates may or may not directly impact property prices.

Even if they do, when interest rates fall, isn’t it more likely that prices will rise since affordability and demand will return?

Therefore, if there is a property that suits your budget and needs, and you have the ability to afford the monthly mortgage safely, there is no reason to miss this opportunity.

Speak to us if you’d like a non-obligatory free consult!